Chapter 17

More From this Chapter

Administrative skills

INSERT GRAPHICS IDENTIFIED BELOW

This section looks at how you can develop your administrative skills as a paralegal. Administrative skills can involve the following:

- Filing

- Bookkeeping

- Looking up a number in the telephone directory

- Arranging and holding meetings

- Managing your time (See Checklist: Best practices for paralegal case-employees)

FILING

Filing means keeping information (papers, letters, addresses) in a safe place. You file information by arranging it in a certain order, so that you or anyone else can find it quickly. You can have real files or set up files for documents on your computer, or do a combination of the two. Filing helps you to decide:

- Where to put information

- Into which file to put a document

- In which file to look to find a document

- Where to find an address

Filing is important because it:

- Helps you not to lose documents

- Keeps documents clean and tidy

- Helps you to find documents quickly and easily

- Helps you to be efficient

WHAT SHOULD YOU FILE?

The important things to file include:

- All documents that your organisation receives, for example letters, notices, reports, and useful information

- All copies of documents you send out

- Documents about the money side of the organisation – receipts, vouchers, deposit slips,etc. If you get documents on email, file them on your computer, or print them out and file a copy. Make copies of slips and vouchers that fade fast – like toll slips.

- All case sheets and information relating to cases and all photographs

Filing should be done according to a carefully planned method. If you use your computer to file all documents you write or receive on email, make sure you create a backup at least once per week. If you have Internet it is worth saving everything on a cloud (a server provided by Google or others). This means you will be able to access the files even if you are in another town or if your computer is lost or crashes.

WHAT EQUIPMENT DO YOU NEED?

You need the following pieces of equipment for filing:

- Files (hanging folders or ring binders)

- A filing cabinet, shelves or something to keep your files in

- A date stamp to put the date on letters you receive – or write the date and sign it

- An A4 size hard-covered book that you call a ‘day-book’

When you start a filing system you need to decide how you want to file. Do you want to file in alphabetical order (for example, using surnames) or in date order (according to the months in the year), or according to issues (such as grants, HIV/AIDS, housing development, etc). Each organisation is different. You should keep your filing system simple and easy for all to operate. Within a file you should file in date order – with the latest documents on top.

REMOVING FILES FROM THE OFFICE

Files should never be removed from the office. If documents or statements have to be removed for any purpose, it is better to photocopy them first so that the original remains in the office.

BOOKKEEPING

Just as you keep records of meetings and letters, you also need to keep records of the organisation’s money. Bookkeeping means keeping records of all the money that you collect and all the money that you spend.

Always keep every piece of paper connected with money, such as invoices, receipts and quotes.

The books you keep must show:

- Income all the money that comes into the organisation (fundraising, donations, and so on)

- Expenditure all the money that is spent (for example on postage, petrol or stationery)

- Balance which is the money that is left over at the end of each month

You keep books so that members can always find out what happens to the money. You need to know how much money you have and how much you still need to collect.

OPENING A BANK ACCOUNT

When you put money into a bank, the bank opens an account for you. When you open a new account you must know:

- What kind of account will be appropriate for your organisation (savings, or current)

- What is the name of your account?

- Who will have authority to sign on the account (the signatories)?

The easiest kind of account for an organisation to use is a current account. The committee of your organisation decides who is allowed to sign for money. There should be at least two (2) signatories to the account. This means two signatories must sign before money can be withdrawn from the account. The two signatories should be members of the management or executive committee who are usually available to sign a requisition form to withdraw cash or authorise making an electronic payment.

Money can also be transferred electronically into people’s accounts but if you want to implement an electronic system you will need to put strict guidelines and clear restrictions as to who will have the authority to do these transfers.

Cash can be taken out of the bank to make small payments, such as for stamps, tea, paper and so on. This money is called petty cash and it is usually kept in a safe place in a small money box in the office. Put all receipts in the petty cash box so it is easy to account for spending.

Putting money into the account is called making a deposit. When you deposit money you fill in a form at the bank called a deposit slip. A copy of the deposit slip will be given to you. If you get EFT deposits, print a record of that or mark it on your bank statement. You must file this for your records.

Taking money out of the account is called a withdrawal. You can withdraw money at the bank teller or at an ATM if you have a bank card. File any slips you get from the bank or ATM. If you are paying electronically (EFTs) you should print out the payment confirmation (receipt) and file it.

The bank statement – Once a month you will receive a bank statement. This is a record of EFTs made in that month as well as all the deposits and withdrawals made.

DAILY RECORDS

The most important books that you must keep for your daily records are:

Receipt book Petty cash vouchers and record book

Receipts

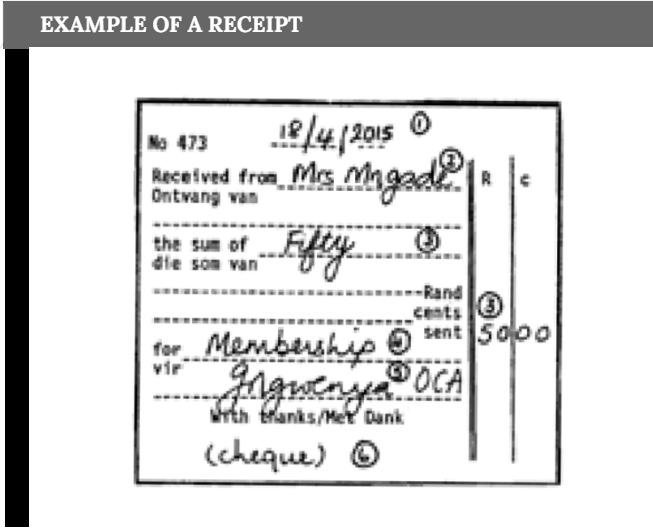

When anyone hands any money to the organisation you must give them a receipt. This receipt proves that money was handed in. You give the original receipt to the person who gave in the money, and the duplicate is left in your receipt book.

When you receive money you should deposit it in the bank as soon as possible. It must never be used as petty cash. It is best to buy a receipt book from a stationery shop and to put your stamp on every page.

Petty cash

You should keep some money in the office for small payments. If you need R500 for tea or milk, you will use petty cash to make these payments. How does petty cash work?

- The treasurer draws an amount of money out of the bank, using a cheque. This amount could be R500 or more depending on what your monthly expenses are and how busy your office is.

- This money is put in a locked metal box called a petty cash box.

- If someone needs money to pay for something for the organisation, the treasurer will give it to them from the petty cash box.

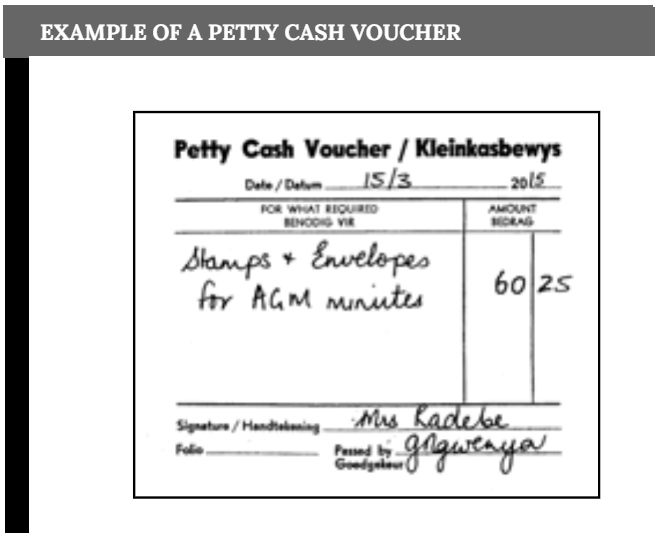

All the petty cash that is spent must be recorded on a petty cash voucher. The receipts, invoices or cash slips that you get when you pay for something must be kept. These slips should be attached to the petty cash vouchers.

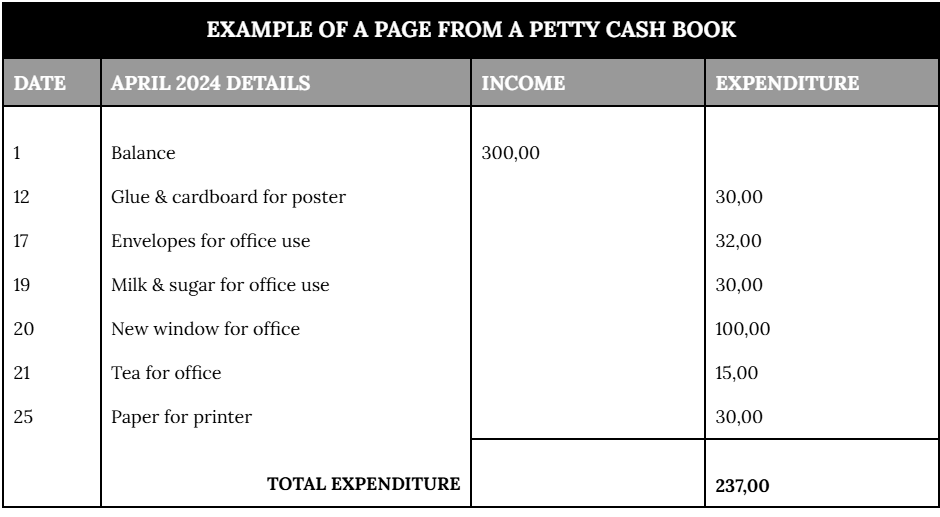

The petty cash book

At the end of each month the treasurer must record the information from all the vouchers in the petty cash book. You can use an ordinary school exercise book for the petty cash book. At the end of the month, the petty cash book must be balanced.

To do this you must:

- Add up the expenditure column to get a total. This is called total expenditure.

- The treasurer must then put back into the petty cash box the same amount of money that was taken out during the month. So, in other words, they must put back the total expenditure. They then record this under income and add up the income column.

MONTHLY INCOME AND EXPENSE RECORDS

The cash book

At the end of each month all the records you keep during the month are recorded in one book called the CASH BOOK. This includes all bank deposit slips, , payment vouchers and petty cash.

You can buy cash books at stationery shops. The deposit slips are the records of the income. The payment vouchers and the petty cash book are the records of the expenditure.

The income and expenditure are recorded in the cash book.

The whole of the left-hand page is the INCOME side of the cash book.

The whole of the right-hand side page is the EXPENDITURE side.

EXAMPLE OF THE INCOME SIDE OF THE CASH BOOK

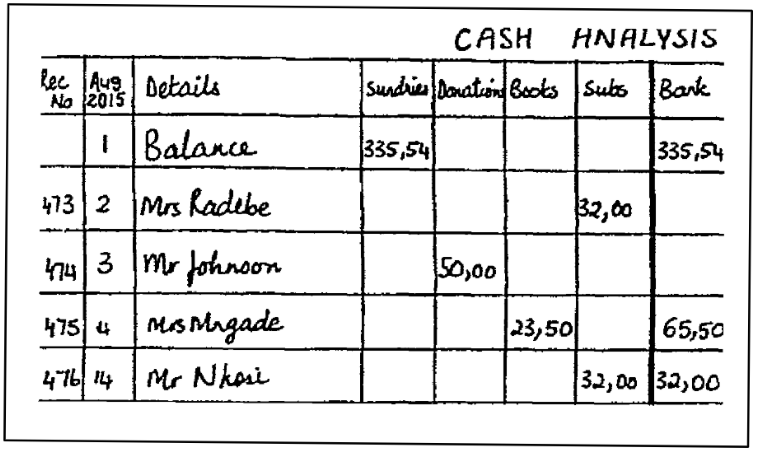

In this example there are 5 main columns on the income left-hand page:

- Receipt number

- Date of receipt

- Details – Write the name of the person or organisation who gave the money.

- Analysis columns – The analysis columns tell us the kind of income it was, for example, donations, subscriptions, books, sundries, and so on. You must decide how many columns you need and what headings you need for these columns. Sundries is for any kind of income – it is like a ‘general’ column.

- Bank – The deposits you put into the bank account are filled in this column.

The amount from each receipt must be written in the correct ANALYSIS column. The amount is also written under BANK when you deposit the money (see example below).

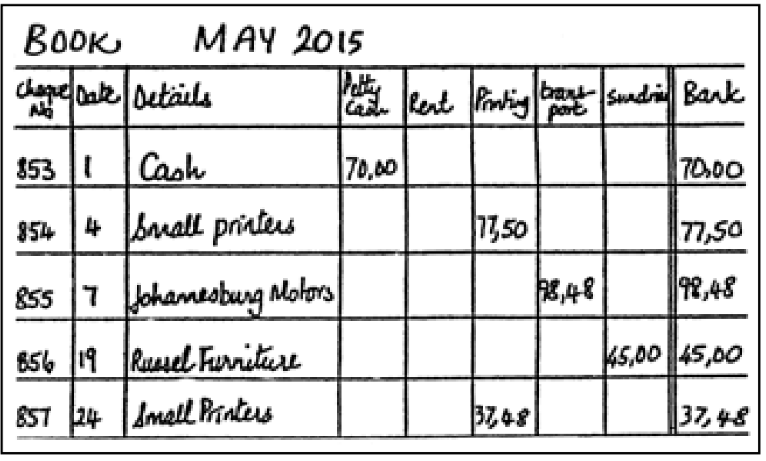

EXAMPLE OF THE EXPENDITURE SIDE OF THE CASH BOOK

All the payments and bank charges are recorded on the expenditure page. This is the right-hand page of the cash book. In this example there are 5 main columns on the expenditure page:

- Transaction number

- Date of each payment

- Details – Write the name of the person or organisation who was paid.

- Analysis – The analysis column tells you what your expenses were, for example, petty cash, rent, printing, transport, sundries, and so on. You must decide how many columns you need and what headings you need for the columns.

- Bank – You write down any WITHDRAWALS from the bank.

All expenditures must be written in the correct ANALYSIS column and under BANK. Bank charges are always recorded under ‘sundries’.

BALANCING THE CASH BOOK

After you have recorded the income and expenditure, you need to work out how much money is left over at the end of the month. This is the balance. To get the balance, subtract the expenditure from the income.

For example, if your total income for May 2024 was R32 571 and the total expenditure was R30 305. To find out how much money was left over subtract R30 305 from R32 571. The balance is R2 266. The balance in your cash book should be the same as the balance in your bank account.

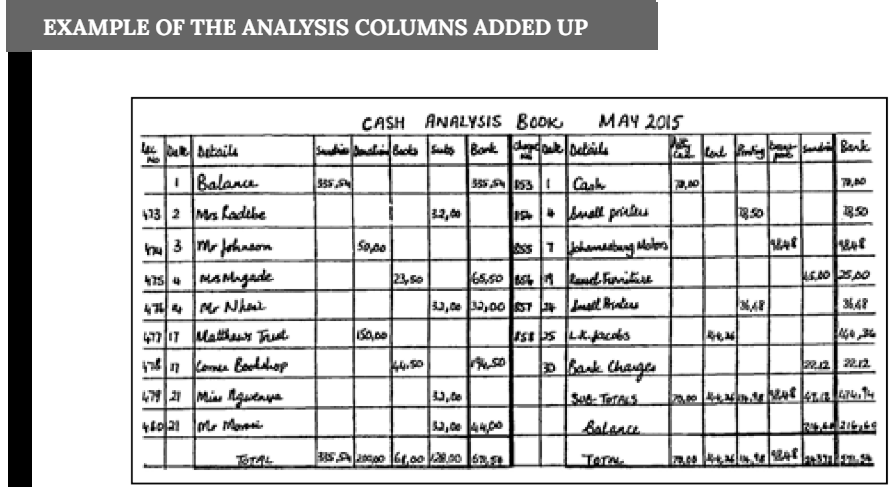

Adding up the analysis columns

The analysis columns tell us what kind of expenditure and what kind of income there was. The analysis columns help us to answer questions like ‘how much money did we get from subs from members in May 2024? To answer this kind of question you need to find the totals for each analysis column.

MONTHLY REPORT-BACKS

The treasurer must give a monthly report to the management or executive committee on the income and expenses of the organisation for that month. All the books should be up-to-date for the report back, for example, the petty cash book and the monthly cash book. The treasurer should have all the cash slips, bank statements, invoices, petty cash vouchers, receipts and so on, at the meeting in case there are questions from the committee.

FINDING A TELEPHONE NUMBER OR ADDRESS IN A TELEPHONE DIRECTORY

All telephone books work in ALPHABETICAL ORDER.

All government departments for national and provincial spheres are listed at the back of the telephone book in both English and Afrikaans. The government departments are listed alphabetically. If there is no number for the department you want in your regional telephone directory, Google it or phone 1023 and get the number of the nearest office.

Provincial government departments are listed under ‘P’ under the heading ‘Provincial Administration’, in the central government departments alphabetical list at the back of the directory.

Metropolitan councils and their departments are also listed at the back of the telephone directory, for example, the Western Cape directory will have contact details of the Cape Town Metropolitan Council and its departments.

Areas that fall outside the metropolitan areas are not listed at the back of the telephone directory with the other government departments. They are listed under ‘M’ alphabetically with all the other telephone numbers in the directory. For example, the municipal council for Mtubatuba is listed under ‘M’ for municipality in the telephone directory for that area.

All hospitals are listed under ‘H’ with all the other numbers in the directory. The hospitals are then listed alphabetically under ‘H’. Doctors are listed under ‘Medical’ alphabetically by name.

All emergency service numbers are listed on one of the first few pages at the front of the directory. If you are using a directory which has many different towns listed in it, then the emergency numbers for each town will appear at the beginning of each of the towns.

MEETINGS

Some ways can help make meetings go well:

- Make sure everyone necessary will be able to attend the meeting.

- The chairperson must plan the agenda in advance so that they know what should be discussed and how long it will take.

- Appoint a chairperson if there is no chairperson.

- Make sure proper minutes are kept.

CHAIRING MEETINGS

Chairing a meeting means facilitating and steering discussion so that the meeting achieves its aims.

At the start of the meeting

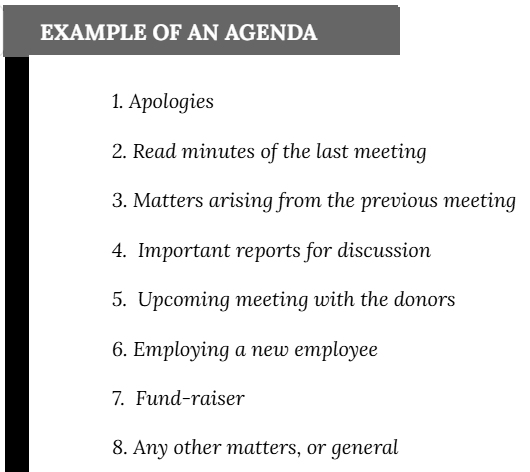

The chairperson starts by reading the agenda and asking whether there are any additions to the agenda. Ideally, the agenda should have been circulated by the secretary to all people attending the meeting at least a week before the meeting takes place. This seldom happens so it is polite to ask the committee at the start of the meeting whether they have anything to add to the agenda. Important matters and items that can be dealt with quickly should be discussed first. An agenda looks like the example below.

During the meeting

Everyone must get a chance to talk. The chairperson must not do all the talking, and must not allow people to interrupt each other or to talk at the same time. The chairperson must make sure that everyone sticks to the topic. The chairperson must work out how much time to spend on each discussion and stop people from wasting time. It is best to introduce each topic briefly and then allow someone to report or give input. Allow for questions and discussion. Give clear direction when a decision is needed – try to outline the options if there are different proposals. Reach a decision by consensus if possible and vote only if needed.

At the end of the meeting

The chairperson must summarise what happened at the meeting. This means going over the important decisions that were made. Everyone must know what they promised to do and by when it must be done.

Preparing for the next meeting

The chairperson asks members when, where and what time the next meeting will be held.

TAKING MINUTES

It is the secretary’s job to take minutes at the meeting. If the secretary is not present, then the chairperson should ask someone else at the meeting to take minutes. Minutes are an important way of keeping a record of what decisions were taken at a meeting. After the meeting, the minutes must be typed or written up neatly in a minute book. A copy should be given or sent to all the committee members. At the beginning of the next meeting, the secretary reads out the minutes of the previous meeting. The main purpose of this is to note corrections and ‘matters arising’: those matters that the previous meeting decided must be finalised or discussed in this meeting, and tasks that people had to do.

TIME MANAGEMENT

There is always too much to do and too little time to do it in. Time management is a skill that can help you to organise your time effectively. It can help you free up time so that you can do more without feeling that you have too much to do.

NOTE: A diary is the most important tool you have when you start to manage your time. Use a book or your cell phone.

To manage the way you use time, you must know what your commitments are, for example to your family, your friends, your job, your organisational work outside of your job.

Problems happen when the demands from different commitments clash. So you need to plan your time.

To do this you must start by identifying your regular commitments and drawing up a list of the demands each commitment makes on you. All your other commitments must be fitted around these routine commitments. Write them in your diary.

Think ahead about all the non-routine things that will happen, so that you start planning for them now (for example, a friend’s wedding, an evaluation of your organisation, and so on).

WHAT ARE THE THINGS THAT IMPACT ON YOUR TIME?

- Being disorganised – wasting time looking for lost documents

- Unrealistic deadlines which mean you always feel you are ‘behind’ with your work

- Spending hours waiting for or getting to meetings

- Constant interruptions

- Feeling too busy and under stress all the time

TIME-WASTERS

Most people waste time in similar ways. Some examples of common time-wasters are:

- Disorganisation

- Procrastination (leaving things to the last minute)

- The inability to say no

- Lack of interest

- Burnout (exhaustion from too much stress)

- Visitors and interruptions

- Telephone calls and emails

- Waiting

- Meetings

- Personal crises

You can identify your own time-wasters and write them down. Then think of ways to avoid these time-wasters.

MANAGING YOUR TIME

When you have many different demands on your time, you must decide which ones to do first, when to do them and how to do them. It is useful to keep a to-do list on your desk, and then allocate the tasks to different days in your diary. Mark the tasks on your list as:

A: Urgent and important – do it soon!

B: Important – do it this week

C: Do it this month

Put both your personal and work tasks on the list, but try to separate them.

If you are too busy to do something, or it is inappropriate for you to do it, then you should hand the task to someone else. This is called delegating.

You must also plan your use of time and set your objectives. Objectives are the things that you plan to achieve. If you are clear about your objectives you can do things in a useful order more easily. Plan your objectives as:

- Long-term objectives (this year – for example, complete my UNISA course)

- Medium-term objectives (this month – for example, complete the funding report)

- Short-term objectives (this week – for example, run a workshop for the community)