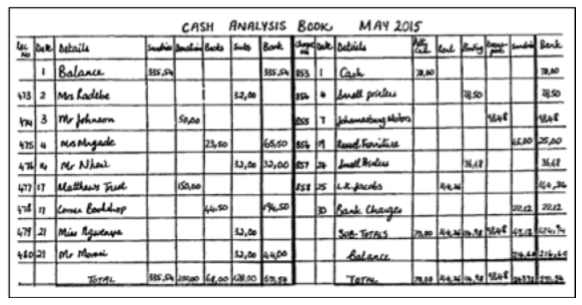

Monthly Income and Expenses Records in an Advice Centre

The Cash Book

At the end of each month all the records you keep during the month are recorded in one book called the CASH BOOK. This includes all bank deposit slips, cheques, receipts and petty cash. You can buy cash books at stationery shops.

The deposit slips are the records of the income.

The cheques and the petty cash book are the records of the expenditure. The income and expenditure are recorded in the cash book.

The whole of the left hand page is the INCOME side of the cash book. The whole of the right hand side page is the EXPENDITURE side.

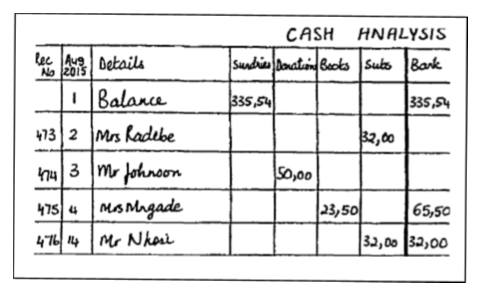

Example:

In this example there are 5 main columns on the income left-hand page:

- Receipt number

- Date of receipt

- Details

Write the name of the person or organisation who gave the money.

- Analysis columns

The analysis columns tell us the kind of income it was, for example donations, subscriptions, books, sundries, and so on. You must decide how many columns you need and what headings you need for these columns. Sundries is for any kind of income – it is like a ‘general’ column (see the example below). - Bank

The DEPOSITS you put into the bank account are filled in this column.

The amount from each receipt must be written in the correct ANALYSIS column.

The amount is also written under BANK when you deposit the money (see example below).

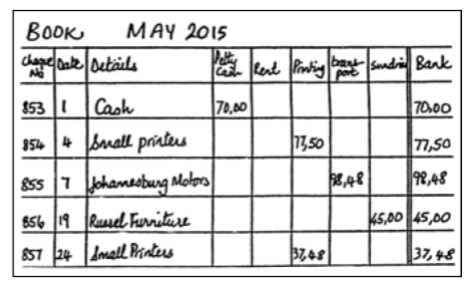

Example of the Expenditure Side of the Cash Book

All the cash and cheque payments and bank charges are recorded on the expenditure page. This is the right hand page of the cash book.

In this example there are 5 main columns on the expenditure page:

- Cheque number (the actual number of the cheque not the amount)

- Date of each cheque

- Details

Write the name of the person or organisation to whom the cheque was made out. For a cash cheque, write ‘CASH’ and what the cash was used for (for example petty cash). - Analysis

The analysis column tells you what your expenses were, for example petty cash, rent, printing, transport, sundries, and so on. You must decide how many columns you need and what headings you need for the columns. - Bank

You write down any WITHDRAWALS from the bank.

All expenditure must be written in the correct ANALYSIS column and under BANK. Bank charges are always recorded under ‘sundries’.

Balancing the Cash Book

After you have recorded the income and expenditure, you need to work out how much money is left over at the end of the month. This is the balance. To get the balance, subtract the expenditure from the income.

For example, if your total income for May 2015 was R12 571 and the total expenditure was R10 305. To find out how much money was left over subtract R10 305 from R12 571.

The balance is R2 266. The balance in your cash book should be the same as the balance in your bank account.

Adding Up the Analysis Columns

The analysis columns tell us what kind of expenditure and what kind of income there was. The analysis columns help us to answer questions like ‘how much money did we get from subs from members in May 2015. To answer this kind of question you need to find the totals for each analysis column.